Lease Accounting for Nonprofit Lessees

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 842: Leases made significant changes to the accounting and reporting of leases on financial statements presented in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). For purposes of this article, we will focus on the impact to lessees under FASB ASC Topic 842.

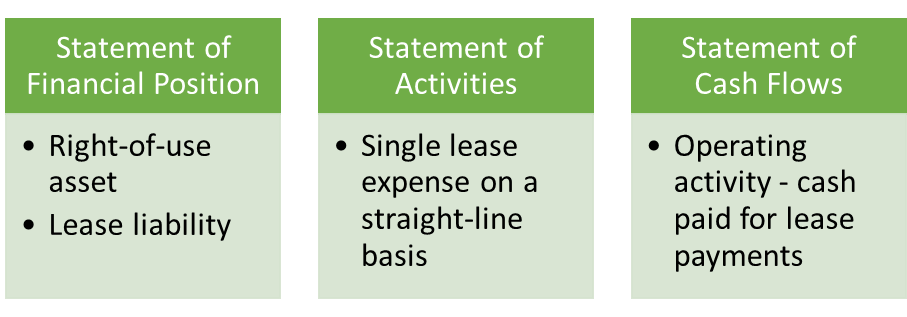

Accounting for Operating Leases

FASB ASC Topic 842 modified the financial reporting requirements for organizations with operating leases with terms of greater than 12 months. Reporting entities, including nonprofit organizations, are required to recognize a right-of-use (ROU) lease asset and lease liability on the statement of financial position for leases classified as operating leases. At initial measurement, the ROU asset and the lease liability are equal to the present value of the required future lease payments. The lessee recognizes a single lease cost, calculated so that the cost of the lease is allocated over the lease term on a generally straight-line basis. The payments are classified as operating payments on the statement of cash flows.

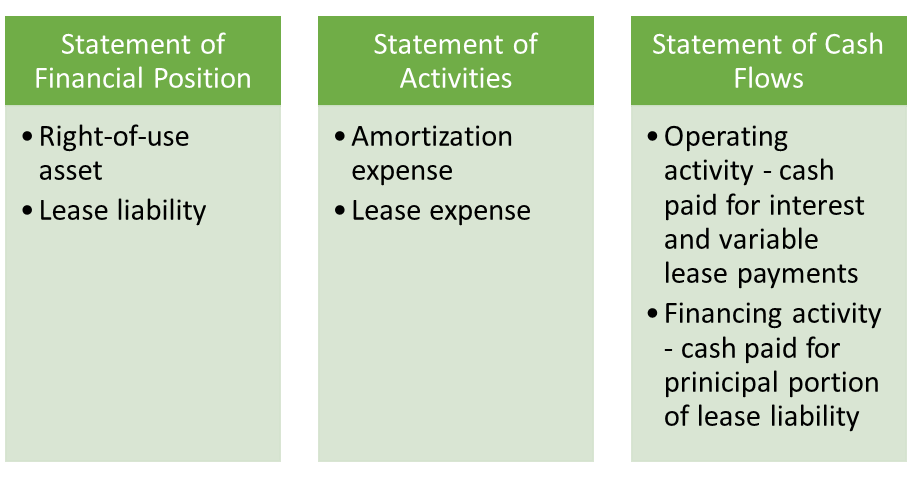

Impact on Capital / Finance Leases

Those leases previously categorized as “capital leases” are considered “finance leases” under FASB ASC Topic 842. Such leases are accounted for and reported in a similar fashion to the previous U.S. GAAP requirements. The lessee recognizes a ROU asset and a lease liability, initially measured at the present value of the lease payments, in the statement of financial position. The lessee recognizes interest on the lease liability separately from amortization of the ROU asset in the statement of activities. On the statement of cash flows, repayments of the principal portion of the lease liability are reported within the financing activities section and payments of interest on the lease liability and variable lease payments are reported within the operating activities section.

Disclosure Considerations

FASB ASC Topic 842 also requires entities to make additional disclosures to help financial statement users understand the amount, timing, and uncertainty of cash flows related to leases. Lessees must also report qualitative and quantitative information, including information about variable lease payments and options to renew leases.

Other Considerations

Nonprofit organizations should ensure their system of internal controls, processes, and procedures properly identify leases and that their accounting policies and practices appropriately address reporting requirements for the leases in accordance with the current provisions of U.S GAAP.

The reporting of leases on the statement of financial position can impact financial covenants for loans. If an organization is considering entering into a new lease, organizations should proactively work with their bankers to consider whether amendments to covenants are appropriate.

Summary

There are many complexities in lease accounting under FASB ASC 842. This article includes a summary of the high points of the new standard from a lessee approach; however, each organization has a unique set of circumstances to be considered. Organizations should reach out to their CPA for additional guidance as needed.