Revisiting Current Expected Credit Losses (CECL) for Nonprofits

Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 326: Financial Instruments—Credit Losses enacted changes to the credit loss recognition threshold for certain financial assets for financial statements presented in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP).

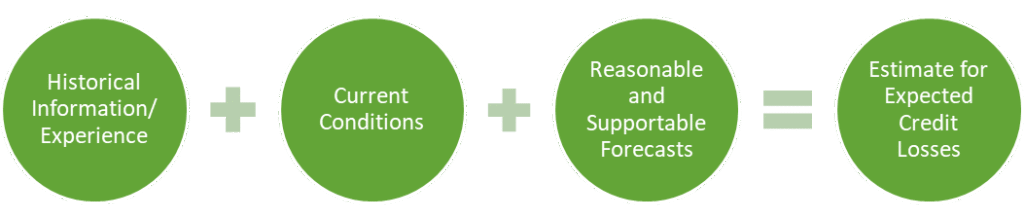

The current expected credit loss model, commonly referred to as the CECL model, requires entities to estimate and measure all (lifetime) expected credit losses for certain financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts about the future.

Overview

Prior U.S GAAP followed an “incurred loss” methodology for recognizing credit losses, which delayed recognition of a loss until it was “probable” the loss had been incurred. The CECL model removed the “probable” threshold for recognition and instead, requires an entity to estimate all (lifetime) expected credit losses over the contractual term of the asset and record an allowance.

The allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial asset to present the net amount expected to be collected on the financial asset. Each type of financial asset measured at amortized cost must have its own respective allowance, and the allowance should be updated and adjusted at each reporting date for management’s current estimate of expected credit losses. The change in the valuation of the allowance gets reported through net income.

To Which Financial Assets does CECL Apply?

CECL applies to any entity with the following:

- Financial assets measured at amortized cost including, but not limited to:

- Trade accounts receivable recognized under ASC Topic 606 (i.e. receivables from program service revenues)

- Contract assets recognized under ASC Topic 606

- Loans and notes receivable

- Held-to-maturity debt securities

- Net investment in leases as a lessor recognized under ASC Topic 842 (i.e. receivables from sales type/direct financing type leases)

- Reinsurance recoverables/receivables

CECL does not apply to contributions or pledges receivable (promises-to-give) and most grants receivable, if following the not-for-profit contribution model reflected in ASC Topic 958-605. Therefore, it’s important for not-for-profits to understand their various types of revenue streams — such as program service revenues and related accounts receivable vs. contribution revenues and related contributions or pledges receivable. To revisit the differences in these types of revenue streams and related receivables, please see our 2024 webinar Annual GAAP Update for Not-for-Profits, where we also discussed CECL, and the following article on contribution accounting: Contribution Accounting Under U.S. GAAP.

There are additional exclusions from CECL, including loans and receivables between entities under common control and receivables from operating leases as a lessor. A full list of exclusions is available within the codification.

Developing an Estimate of Expected Credit Losses

The standard requires entities to “pool” or group financial assets that share similar risk characteristics when developing an estimate for the allowance for expected credit losses. Examples of risk characteristics include age, term, industry, size, or geographic location. The groupings should be consistent with the organization’s policies for monitoring credit risk.

The standard does not require a specific estimation method be used, nor does state what type of information to use when developing an estimate of expected credit losses. Your organization can use judgement in determining what information is most relevant to your financial assets and related risks of collectability. The measurement should be based on three components: historical loss information, current conditions, and forward-looking information (reasonable & supportable forecasts) that affect the collectability of the reported amount.

The allowance should be assessed and updated at each reporting date, and should generally follow the same method used to initially measure expected credit losses for the financial asset. In addition, the standard does not have a minimum threshold, so entities are required to consider the expected credit losses on applicable assets even if, as an organization, you believe there is a low risk of loss.

To address some challenges entities were encountering when developing their allowance estimate, in July 2025, the FASB issued Accounting Standards Update (ASU) 2025-05: Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses for Accounts Receivable and Contract Assets. This update introduces the following practical expedient for all entities, and an accounting policy election for entities other than public business entities, related to applying ASC Topic 326-20 to current accounts receivable and current contract assets that result from transactions accounted for under ASC Topic 606.

- Practical Expedient – In developing reasonable and supportable forecasts as part of estimating expected credit losses, all entities may elect a practical expedient that assumes that current conditions as of the statement of financial position date do not change for the remaining life of the asset.

- Accounting Policy Election – An entity other than a public business entity that elects the practical expedient is allowed to make an accounting policy election to consider collection activity after the statement of financial position date when estimating expected credit losses.

ASU 2025-05 is effective for annual periods beginning after December 15, 2025 (i.e. starting with 2026 calendar year-ends), however early adoption is permitted for any financial statements not yet issued or made available for issuance.

Presentation and Disclosure

The allowance must be presented as either a separate line item on the face of the statement of financial position, or separately disclosed in the footnotes if presented net of accounts receivable on the statement of financial position (e.g. Accounts receivable, net of allowance of $x,xxx).

Disclosures require additional information by portfolio segment, including but not limited to how the credit loss estimates are developed, descriptions of significant accounting policies and methodology to estimate the allowance, factors that influence management’s current estimate of expected credit losses, risk characteristics relevant to each portfolio segment, and a roll-forward of the activity in the allowance for credit losses during each reporting period.

Additionally, organizations must disclose when they have elected the practical expedient and the accounting policy election available under ASU 2025-05 described above, as well as through which date subsequent collection activity has been considered when the accounting policy election is made.

Summary

This article includes a summary of some of the key aspects of the expected credit loss model as it impacts non-profit organizations; however, each organization has a unique set of circumstances that need to be considered. Reach out to your CPA for additional guidance as needed.